Olympus Property REIT, LLC

A Multifamily REIT Opportunity Focused On

Geographically Diversified Class A Assets

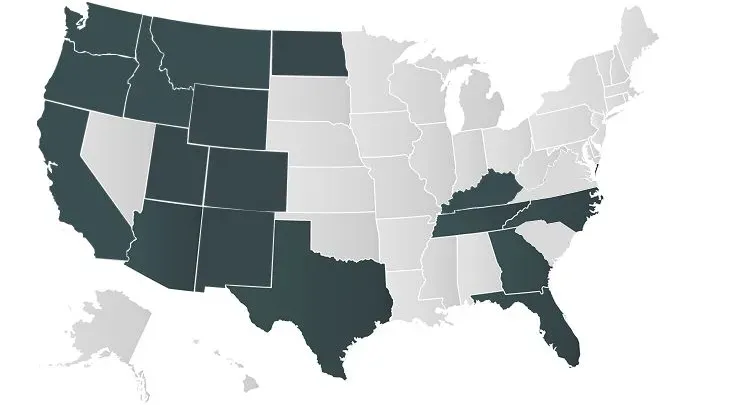

Olympus Property REIT, LLC (the "REIT") specializes in targeting premier Class A multifamily assets in premier locations. The REIT focuses on investing in high-growth markets across the United States with strong population and employment growth fundamentals. Assets are located in top-tier neighborhoods with favorable supply dynamics for sustainable yields.

Initial Offering Summary1

No. of Assets

No. of Units

Average Vintage

Million in Equity2

Offering Details

Initial Offering Size

$200,000,000

Offering Type

Perpetual-life non-traded private real estate investment trust

Targeted Distributions

Quarterly

Preferred Hurdle

8%

Promote (above hurdle amount) 3

80% / 20% Investor / Advisor split

Liquidity4

Quarterly, subject to a quarterly cap of 5% of fund

Nav Frequency

Quarterly

Minimum Investment

$50,000 (can be waived at REIT discretion)

Distribution Reinvestment Plan

Shareholders may opt in to reinvest distributions through the purchase of additional shares at then current NAV

Suitability

Accredited Investors

Tax Reporting

K-1 for the initial year, 1099-DIV thereafter

- Summary of current offerings, with ongoing property additions.

- REIT's ownership interest represents $12.8M.

- Also subject to a high-water mark.

4. Shares are illiquid first 12 months and purchased at NAV thereafter.

5. The REIT’s investments strategy is speculative and entails substantial risks. There can be no assurance that the investment objectives of the REIT will be achieved or that limited partners will avoid significant or even total losses of their investments in the REIT.

Featured Properties

- Comprehensive operational strategy and scalable infrastructure drive competitive advantages and attractive investment returns.

- Proven track record success across economic cycles.

- National footprint with high-touch operating model and local expertise.

Disclosures & Risk Factors

Disclosures

This sales and advertising literature is neither an offer to sell nor a solicitation of an offer to buy securities. This brochure must be read in conjunction with the PPM in order to fully understand all of the implications and risks of the offering of securities to which this brochure relates. Neither the Securities and Exchange Commission, nor any state securities regulator has approved or disapproved of our common stock, determined if the brochure is truthful or complete or passed on or endorsed the merits of the offering. Any representation to the contrary is a criminal offense.

Securities offered by ARKAP Markets - Member FINRA/SIPC. Olympus and ARKAP Markets are not affiliates.

Any testimonials may not be representative of the experience of other customers. Testimonials are no guarantee of future performance or success.

Investing in any offering involves risk. Returns are not guaranteed, and past performance is not a guarantee of future results. There is no guarantee that the Olympus Capital Real Estate’s 1031 DST will be successful in executing its business plan, including its investment objectives, hold period, or exit strategy.

Pictures are properties in the Olympus Property portfolio.

Risk Factors

An investment in shares of common stock of Olympus Property REIT I LLC (“OP REIT”) is highly speculative and involves a high degree of risk. These securities should only be purchased if you can afford to lose your complete investment. Please read the PPM for a description of the material risks associated with an investment in OP REIT.

Statements contained in this sales material that are not historical facts are based on our current expectations, estimates, projections, opinions or beliefs. Such statements are not facts and involve known and unknown risks, uncertainties, and other factors. Prospective investors should not rely on these statements as if they were fact. No representation or warranty is made as to future performance of OP REIT. In light of the significant uncertainties inherent in these forward-looking statements, the inclusion of this information should not be regarded as a representation by us or any other person that our objectives and plans, which OP REIT considers to be reasonable, will be achieved.

You should carefully review the “Risk Factors” section of the PPM for a discussion of the risks and uncertainties that OP REIT believes are material to its business, operating results, prospects and financial condition. Except as otherwise required by federal securities laws, OP REIT does not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The following are some of the risks as stated in the RISK FACTORS section of the PPM:

- Reliance on the Advisor and Sponsor

- Changes in our investment policies

- Variance in price and value of investment

- Inability to maintain a specified level of distributions

- Paying distributions from any source, including from sources other than cash flows from operations

- Ability to obtain financing or adverse economic/property conditions impacting debt strategies

- Limitations on transfers of Interests

- No public market currently exists for our units

- Failure to qualify as a REIT

- Ability to find suitable investments

- General Partner, Investor, Advisor, Sponsor, and affiliate conflicts of interest

- Liquidity of real estate and unit